very time there’s a rumor about a change to China’s income taxes, it prompts heated online discussion, followed by official rebuttals. One example of this recently was a hot debate over whether somebody earning 120,000 yuan (US$17,700) a year was in the “high-income” group, which abated after the tax authorities said there was no official definition for such a group.

But the tax reforms have generated public concerns because China’s income tax has effectively become a payroll tax, deducted from people’s wage packets instead of being assessed as a whole every year as is in most developed countries. That lets a lot of income among the rich go untaxed, while taking money from working people – and has intensified public criticism of the unfairness of the system as a result.

Liu Jianwen, director of the China Association for Fiscal and Tax Law, and a law professor at Peking University, told NewsChina that there have been numerous public appeals over the current tax reforms and strict legislative procedures should be followed during the process of reform in order to avoid mistaken decisions, reduce the risk of bad enforcement, and ease public anxieties.

NewsChina: The references to 120,000 yuan (US$17,700) as a threshold come from 2005 taxation regulations. How was that amount picked?

Liu Jianwen: The revision to the income tax in 2005 is worth remembering because it’s the first time public hearings were introduced in the Chinese legislative process. A total of 20 representatives were selected from 5,000 to 6,000 candidates and I was lucky to be one of them, and the only law professor.

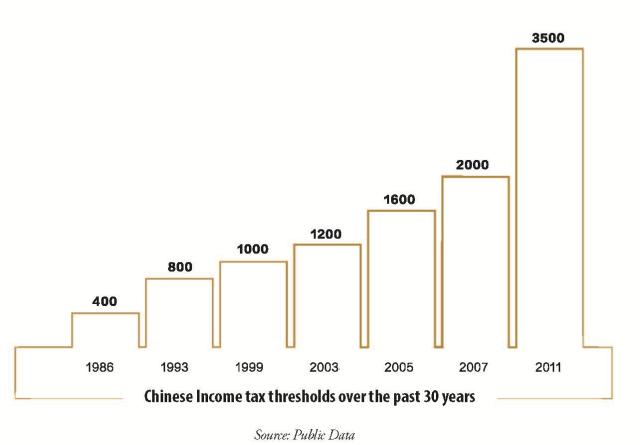

In the revision, taxation authorities announced that individuals who earn more than 120,000 yuan (US$17,700) a year should declare their incomes to be taxed appropriately – because at that time it really was a high amount. In 2010, the State Administration of Taxation released a guideline to reform the income tax system by adding people who are involved in equity deals and real estate property transactions, film stars and some financial workers to the high income group in a bid to tighten supervision. Back then, however, neither the legal circles nor academia defined people with an annual income of 120,000 yuan (US$17,700) as the high income group, but among the public the amount was deemed the yardstick of a high income.

Since 2005, China’s GDP and fiscal revenues have increased by several times and living standards have improved substantially. To many people, 120,000 yuan (US$17,700) is a standard only slightly higher than the average, particularly in major cities. If this amount becomes the benchmark to define high income groups, the public will strongly resist the move.

NC: Many people think that the income tax has become a payroll tax. Do you agree?

Liu: There’s definitely an academic consensus that income tax has become a payroll tax, even though that wasn’t the intention. There is still a long way to go to establish a tax collection and management system targeting real high earners. There are many reasons to blame for this, including ignorance about property transaction prices and the actual income of film stars, as well as the lack of a registration system for equity trading. Taxation authorities have failed to master the detailed information of tax payers. In addition, unlike overseas countries, there is a disconnect between tax payments and the personal credit system in China.

NC: China currently breaks income tax into different categories. What are the problems with this?

Liu: The advantage is that it’s simple, clean, and easy to calculate, but it’s not always fair. Some people have multiple sources of income and some have a single source of income, but people with multiple sources can benefit from a whole set of possible deductions. For example, a professor might have personal service payments and royalty payments in addition to their monthly salary, and be able to claim deductions on all of them.

Treating income as a single figure, just like China’s corporate income tax, plays a key role in fair income redistribution but it hardly reflects the differences of individual earnings.

Old Version

Old Version